does cash app report to irs reddit

Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS Americans for Tax Reform President Grover Norquist discusses the impact of third-party.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Each year you carried out more than 200 transactions.

. After some quick research it appears it is possible to receive money into your Cash App account from the IRS if they have the routing number and account number on file thats. There has been a flurry of furious cash app users this past week angrily responding to rumors of president joe bidens new tax reporting plan. Form 1099-K Payment Card and Third Party Network.

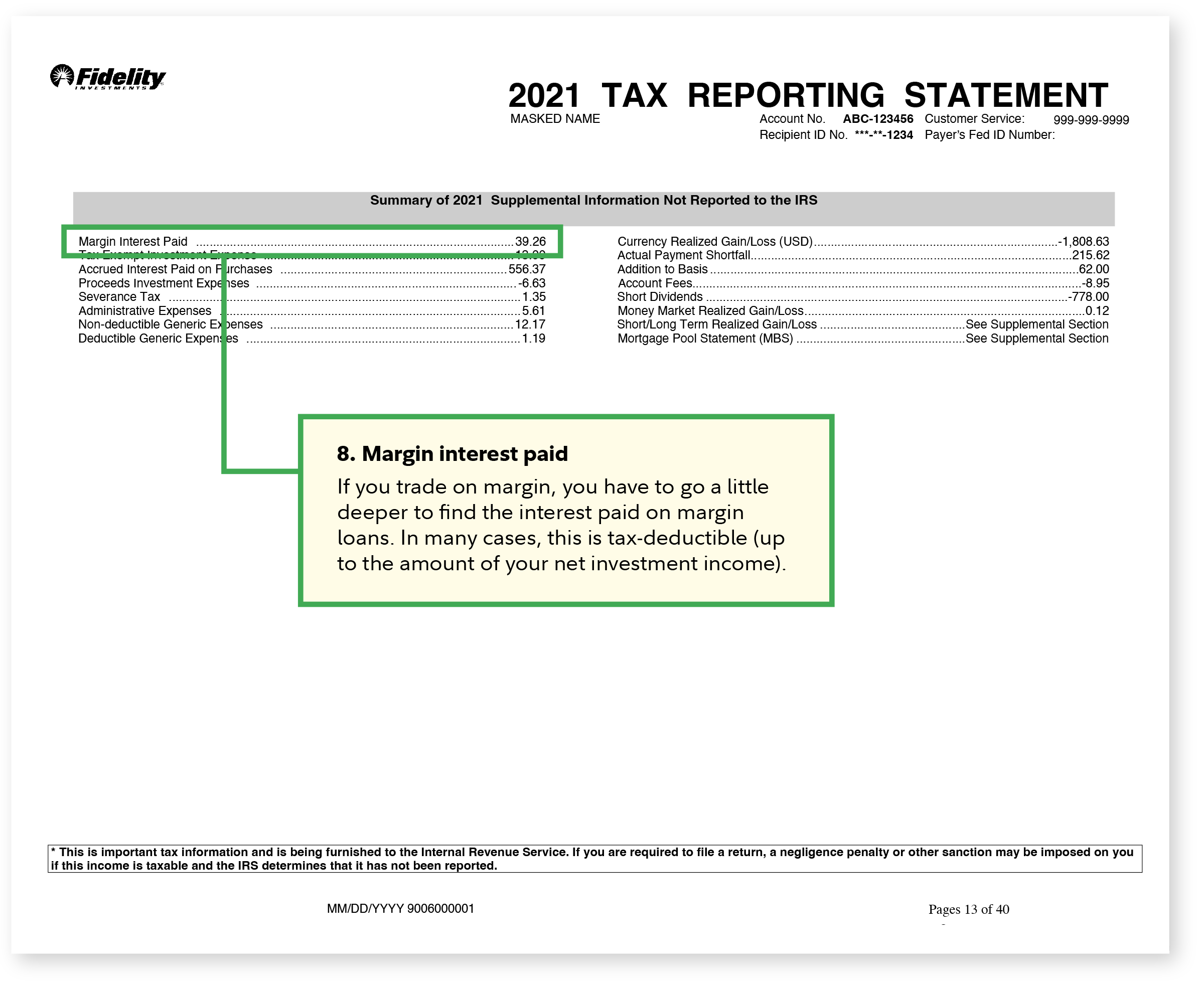

Make sure you fill that. A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS.

Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. Cash apps must now disclose payments for goods and services. Paypal venmo cash app required to report transactions exceeding 600.

Personal Cash App accounts are exempt from the new 600 reporting rule. Oct 19 2021 If you are using a cash app for business and make more than 600 a year in transactions the IRS wants to know. The answer is very simple.

And the IRS website says. As of january 1 the irs will change the way it taxes income made by businesses that use venmo. Cash App is required by law to file a copy of the Form 1099-BK to the IRS for the applicable tax year.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. A person must report cash of more than. 1 2022 users who send or receive.

The American Rescue Plan however altered these rules.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Reporting Income On Stolen Property Can Someone Explain This R Irs

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Report Interest Income To Irs Even If It S Just 50 Cents

Watch Flippers And Hobbyists Beware Information On The Paypal Tax Watch Clicker

The Irs Is Clamping Down On Cash Apps Could This Affect Your Rental Business

Irs Snooping On Cash Apps It S Coming Soon Bold Tv

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Cash App Income Is Taxable Irs Changes Rules In 2022

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

How To Read Your Brokerage 1099 Tax Form Youtube

Irs Snooping On Cash Apps It S Coming Soon Bold Tv

Report Your Illegal Income To Irs This Is 100 Real Source Https Www Irs Gov Publications P17 R Cringepics

Truth Or Hoax Is The Irs About To Tax Your Venmo And Zelle Transfers Nbc4 Wcmh Tv

Starting January 1 2022 Cash App Business Transactions Of More Than 600 Will Need To Be Reported To The Irs R Cryptocurrency