how much does nc tax your paycheck

What is North Carolinas State Income Tax. Gross income means all income you received in the form of money goods property and services that isnt exempt from tax including any income from sources outside North Carolina.

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief

North Carolina Estate Tax.

. Social Security has a wage base limit which for 2022 is. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. Your average tax rate is 1198 and your.

What percentage of tax is taken out of my paycheck in Colorado. Based on economic conditions an employers tax rate could be as low as 0060 or as high as 5760. The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were. Your paycheck needs protection. 6th Fl Durham NC 27701.

The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. Any wages above 147000 are. 2019 Individual Income Tax Estimator.

2020 Individual Income Tax. Take Your 2019 Standard Deduction. Federal unemployment taxes are calculated at the 6 rate for the first 7000 of the employees annual salary.

The income tax is a flat rate of 499. North Carolina has not always had a flat income tax rate though. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Just enter the wages tax withholdings and other information. For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575. Your employee should provide you with an Employees Withholding Allowance Certificate.

This form and the North. North Carolina has not always had a flat income tax rate though. 124 to cover Social Security and 29 to cover Medicare.

Detailed North Carolina state income tax rates and brackets are available. This tax can be reduced up to 54 by paying the North Carolina. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies.

North Carolina Income Tax Calculator 2021. No state-level payroll tax. If you or your tax.

This 153 federal tax is made up of two parts. The amount of taxes to be. Yes and its a flat 499.

Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. The median household income is 52752 2017. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes.

Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Each employers payroll for the last three fiscal years as of July 31 of the current year.

North Carolina Gas Tax.

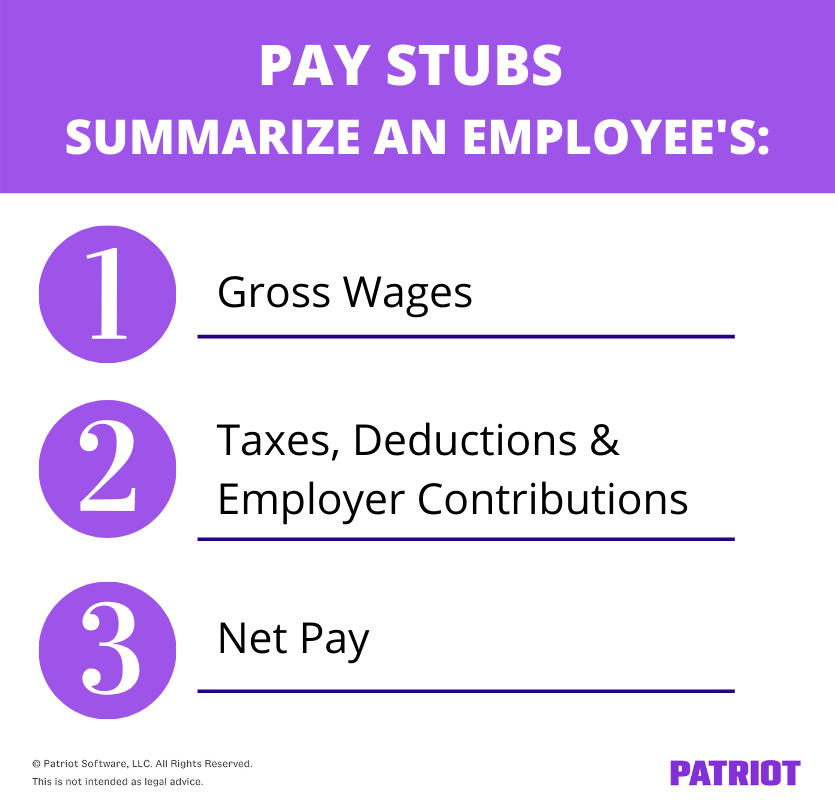

Pay Stub Requirements By State Overview Chart Infographic

Payroll Tax What It Is How To Calculate It Bench Accounting

Want A Bigger Paycheck In 2021 Here S How To Get One

Final Paycheck Laws By State Findlaw

Paperwork Needed For Buying A House Home Buying Process Home Buying Buying Your First Home

How Many Tax Allowances Should I Claim Community Tax

Titanic Infographic Brewery Tax Deductions

Get To Your Weekly Paycheck Goal Paycheck Amazon Fba Business Money Matters

Understanding Your W 2 Controller S Office

Handpick The 52 Week Money Saving Challenge For 52 Week Money Saving Challenge Money Saving Strategies Money Plan

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Deciphering Your Paycheck 10 Things To Know America Within Education Lessons Business Education Federal Income Tax

What Is A 401k 401k Retirement Planning Mutuals Funds

Prorated Salary Easy Guide Calculator Hourly Inc

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

How To Do Payroll In Excel In 7 Steps Free Template

How To Organize Tax Records Tax Organization Blog Organization Organization

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero